Comprehensive Guide To Health Insurance Nebraska: What You Need To Know?

With healthcare costs rising steadily, having the right coverage is more important than ever. Nebraska offers a variety of insurance options, from employer-sponsored plans to individual marketplace policies, each designed to meet different needs and budgets. Understanding these options can be overwhelming, but with the right guidance, residents can make informed decisions that align with their healthcare needs and financial capabilities. The state's health insurance landscape has evolved significantly in recent years, with new regulations and market dynamics shaping the available choices. Nebraska's residents benefit from both federal and state-specific programs, including Medicaid expansion and various subsidies for marketplace plans. These developments have made health insurance more accessible, particularly for low-income families and small business owners. However, navigating these options requires understanding key factors such as premium costs, coverage limits, and network providers. This comprehensive guide will explore every aspect of health insurance Nebraska, from understanding basic coverage to exploring specialized plans. We'll examine how different life stages and health conditions affect insurance needs, discuss the impact of recent policy changes, and provide practical advice for selecting the best coverage. Whether you're a young professional, a growing family, or a senior citizen, this article will equip you with the knowledge to make informed decisions about your healthcare coverage in Nebraska.

Table of Contents

- What Are the Types of Health Insurance Plans Available in Nebraska?

- How Does Health Insurance Nebraska Work for Employers and Employees?

- What Are the Key Factors to Consider When Choosing a Health Insurance Plan?

- Specialized Coverage Options in Nebraska

- How Do Life Stages Affect Health Insurance Needs?

- What Are the Latest Policy Changes Affecting Nebraska Residents?

- Practical Tips for Managing Health Insurance Costs

- Frequently Asked Questions About Health Insurance Nebraska

What Are the Types of Health Insurance Plans Available in Nebraska?

Nebraska's health insurance market offers diverse options to accommodate various needs and preferences. The most common types include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Exclusive Provider Organizations (EPOs), and High Deductible Health Plans (HDHPs) often paired with Health Savings Accounts (HSAs). HMO plans typically require selecting a primary care physician and obtaining referrals for specialist visits, while PPOs offer more flexibility in choosing healthcare providers without referrals. EPOs strike a balance between these two options, offering a network of preferred providers without the need for referrals. When considering health insurance Nebraska options, it's essential to understand the differences in cost structures. HMOs generally feature lower premiums but require staying within the network for coverage. PPOs, while more expensive, allow out-of-network care at higher costs. HDHPs combined with HSAs present an attractive option for healthy individuals who want to save for future medical expenses while enjoying lower premiums. These plans typically have deductibles of $1,400 or more for individuals and $2,800 for families, but they offer significant tax advantages through pre-tax contributions to HSAs. The state's marketplace also offers catastrophic plans for individuals under 30 or those qualifying for hardship exemptions. These plans feature extremely low premiums but high deductibles, making them suitable for young, healthy individuals who want protection against worst-case scenarios. Nebraska residents can also explore short-term health insurance options, which provide coverage for periods ranging from 30 days to 364 days. However, these plans often exclude pre-existing conditions and may not cover essential health benefits required by the Affordable Care Act.

How Do Employer-Sponsored Plans Differ from Individual Marketplace Options?

Employer-sponsored health insurance Nebraska plans typically offer more comprehensive coverage at lower costs due to group purchasing power. These plans often feature additional benefits such as dental, vision, and life insurance coverage. The main advantage lies in the shared premium costs, with employers typically covering 70-80% of the premium expenses. However, these plans may limit provider choices to specific networks and require employees to meet certain eligibility requirements.

Read also:Aagmal Unveiling The Secrets Of An Enigmatic Concept

What Are the Advantages of Marketplace Plans for Self-Employed Individuals?

Marketplace plans provide crucial flexibility for self-employed individuals and small business owners. These plans offer standardized coverage options with clear benefit summaries and price comparisons. Nebraska's marketplace plans are categorized into Bronze, Silver, Gold, and Platinum tiers, each offering different cost-sharing structures. Subsidies and tax credits are available for eligible individuals, making these plans more affordable. The marketplace also provides access to essential health benefits, including preventive care, maternity services, and mental health treatment.

- Marketplace plans must cover ten essential health benefits

- Open enrollment periods run from November 1 to January 15 annually

- Special enrollment periods are available for qualifying life events

How Does Health Insurance Nebraska Work for Employers and Employees?

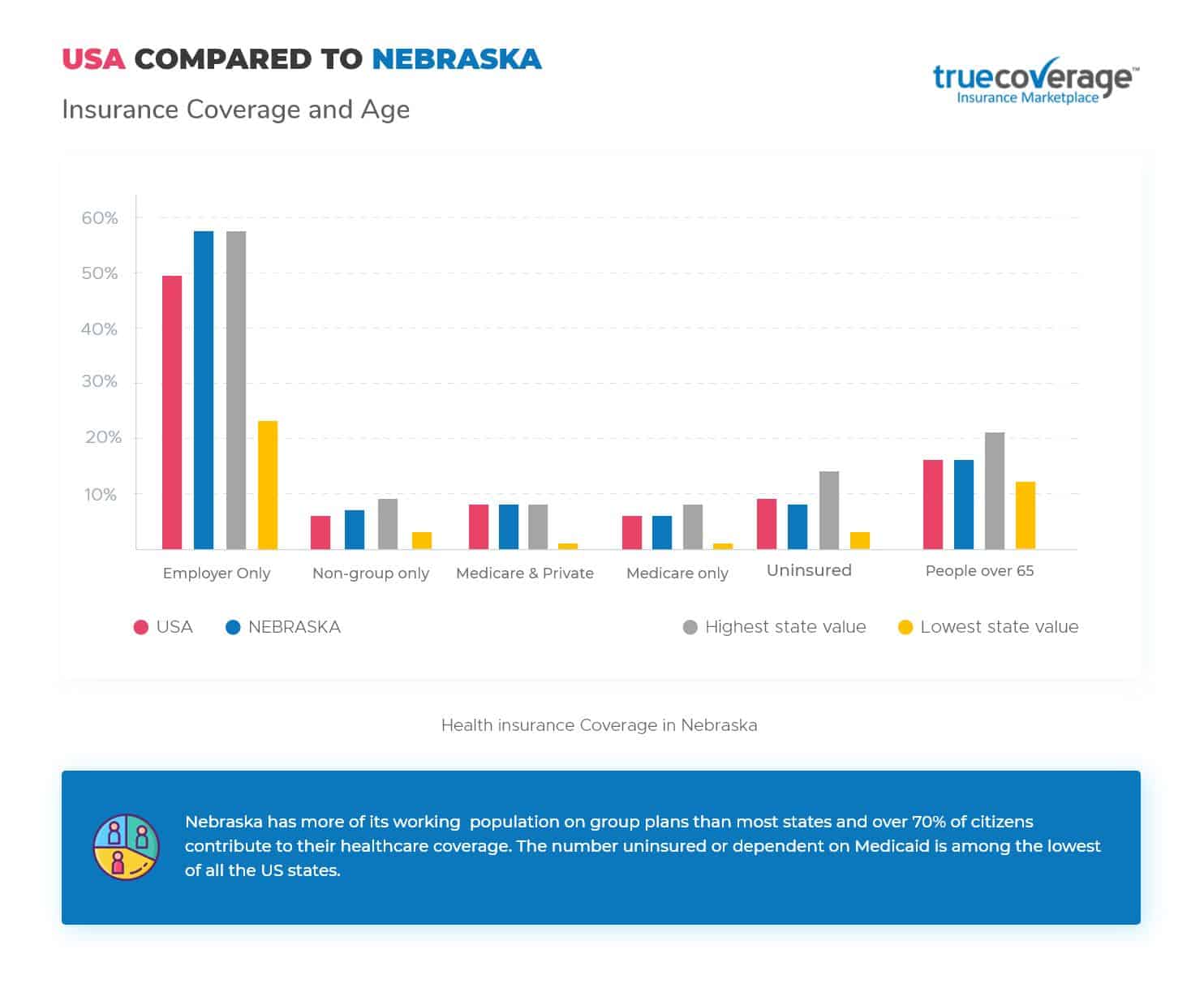

Employer-provided health insurance Nebraska programs play a vital role in the state's healthcare ecosystem, covering approximately 56% of the population. For employers, offering health insurance serves as a crucial tool for attracting and retaining talent while potentially reducing turnover costs. Nebraska law requires businesses with 50 or more full-time employees to provide health insurance, aligning with federal mandates. However, many smaller businesses voluntarily offer coverage to remain competitive in the labor market. Employees benefit significantly from employer-sponsored plans through pre-tax premium deductions and shared costs. These plans typically feature lower deductibles and out-of-pocket maximums compared to individual marketplace options. Nebraska employers often enhance their offerings with wellness programs, telemedicine services, and flexible spending accounts (FSAs). The state's insurance regulations ensure that pre-existing conditions cannot be used to deny coverage or charge higher premiums in employer-sponsored plans. The implementation of the Affordable Care Act has introduced additional protections for Nebraska workers. Employers must now provide coverage that meets minimum value standards, covering at least 60% of medical costs. This requirement has led to improved benefit packages across the state. Additionally, Nebraska's insurance commissioner actively monitors premium increases, ensuring they remain reasonable and justified. Employers can choose from various plan designs, including traditional group plans, self-insured options, and association health plans, each offering different cost-sharing arrangements.

What Are the Financial Implications for Nebraska Employers?

Providing health insurance Nebraska coverage presents both costs and benefits for employers. While premium contributions represent a significant expense, businesses can claim tax deductions for these costs. The state offers small business health insurance tax credits for companies with fewer than 25 employees, helping offset premium expenses. Employers also benefit from reduced absenteeism and increased productivity when employees have access to preventive care and timely medical treatment.

How Does Nebraska's Insurance Market Support Small Businesses?

Nebraska's Small Business Health Options Program (SHOP) marketplace provides tailored solutions for small businesses, allowing them to compare plans and manage employee coverage efficiently. This platform offers standardized plan options, simplifying the selection process for business owners. The state also supports small business insurance pools, enabling companies to band together and negotiate better rates through collective bargaining.

- Employers can choose from multiple insurance carriers through SHOP

- Businesses with fewer than 50 employees aren't required to provide coverage

- Tax credits can cover up to 50% of premium costs for eligible small businesses

What Are the Key Factors to Consider When Choosing a Health Insurance Plan?

Selecting the right health insurance Nebraska plan requires careful consideration of multiple factors beyond just monthly premiums. Coverage scope should be the primary consideration, examining what services are included and any limitations or exclusions. Nebraska residents should evaluate their anticipated healthcare needs, including prescription medications, specialist visits, and preventive care requirements. Understanding the plan's network of providers is crucial, as out-of-network care can lead to significant expenses even with insurance coverage. Cost-sharing structures represent another critical consideration. Deductibles, copayments, and coinsurance percentages vary widely between plans and can significantly impact out-of-pocket expenses. Nebraska's insurance marketplace provides standardized plans that make these comparisons easier, but individuals must still assess how these costs align with their financial situation. The annual out-of-pocket maximum serves as an important safety net, capping the total expenses a policyholder might face in a year.

How Can Nebraska Residents Evaluate Provider Networks Effectively?

Provider networks directly affect access to preferred doctors and hospitals. Nebraska residents should verify that their current healthcare providers participate in the plan's network and understand any restrictions on specialist visits. Some plans require referrals from primary care physicians, while others allow direct access to specialists. The plan's service area is particularly important for rural residents, as network coverage may vary across different regions of the state.

Read also:El Patroacuten Viral Unlocking The Secrets Of Viral Content

What Role Do Prescription Drug Formularies Play in Plan Selection?

Prescription drug coverage often represents a significant portion of healthcare expenses. Nebraska insurance plans maintain different formulary tiers that determine copayment amounts for medications. Residents should review their current prescriptions against the plan's formulary, noting any restrictions or requirements for prior authorization. Some plans offer mail-order pharmacy options that can reduce medication costs significantly.

- Verify that preferred hospitals and specialists are in-network

- Check prescription drug coverage and formulary tiers

- Evaluate telemedicine and virtual care options

Specialized Coverage Options in Nebraska

Nebraska offers several specialized health insurance options catering to unique population needs. Medicaid expansion has significantly increased coverage for low-income residents, with over 90,000 Nebraskans now eligible for comprehensive benefits. The state's Children's Health Insurance Program (CHIP) provides affordable coverage for families earning too much for Medicaid but unable to afford private insurance. These programs feature comprehensive benefits including dental, vision, and mental health services, ensuring comprehensive care for vulnerable populations. For senior citizens, Nebraska's Medicare Advantage plans offer enhanced benefits beyond traditional Medicare coverage. These plans often include prescription drug coverage, dental and vision benefits, and wellness programs. The state's insurance market also supports specialized plans for individuals with chronic conditions, offering coordinated care management and additional benefits. Nebraska's health insurance regulations mandate coverage for essential health benefits, including maternity care, mental health services, and substance abuse treatment.

What Are the Options for Small Business Owners?

Small business owners in Nebraska can access specialized insurance products through the state's marketplace and association health plans. These options provide flexibility in coverage design while maintaining compliance with federal and state regulations. The state's insurance department actively monitors these plans to ensure they meet minimum coverage standards and provide adequate consumer protections.

How Does Nebraska Support Rural Healthcare Access?

Rural residents benefit from Nebraska's innovative telehealth coverage requirements, which mandate insurance plans to cover virtual care services at the same rate as in-person visits. This policy has significantly improved access to specialists and mental health services in underserved areas. The state also supports rural healthcare providers through various grant programs and insurance reimbursement initiatives.

- Medicaid expansion covers adults earning up to 138% of the federal poverty level

- CHIP offers coverage for families earning up to 205% of the federal poverty level

- Telehealth services are covered equally with in-person visits

How Do Life Stages Affect Health Insurance Needs?

Different life stages necessitate varying health insurance Nebraska requirements, from young adulthood through retirement. Young professionals typically prioritize affordable premiums and preventive care coverage, often selecting high-deductible plans paired with HSAs. As individuals start families, their insurance needs shift to include maternity coverage, pediatric care, and family benefits. Nebraska's insurance marketplace offers family plans that provide comprehensive coverage for dependents while maintaining reasonable costs. For middle-aged adults, health insurance needs often expand to include chronic condition management and specialty care. Many Nebraska residents at this stage opt for plans with lower deductibles and broader provider networks to accommodate increased healthcare utilization. The state's insurance regulations ensure coverage for essential health benefits, including preventive screenings and wellness visits, which become increasingly important during these years.

What Are the Insurance Considerations for Senior Citizens?

Seniors face unique health insurance challenges as they transition from employer-sponsored coverage to Medicare. Nebraska offers various Medicare supplement plans to help cover gaps in traditional Medicare coverage, including copayments, deductibles, and coinsurance. The state's insurance market also provides Medicare Advantage plans that bundle medical and prescription drug coverage while offering additional benefits like dental and vision care.

How Does Health Insurance Nebraska Address Pediatric Needs?

Pediatric coverage represents a crucial consideration for families in Nebraska. All marketplace plans must include pediatric services as part of their essential health benefits package. These services encompass well-child visits, immunizations, and developmental screenings. The state

Exploring The Rich History And Impact Of The Lincolnton Herald: A Local Legacy?

What Is The Capital Of Salem? Exploring The City’s Identity

How To Vote For Your Favorite Celebrity On Votar La Casa De Los Famosos

Affordable Nebraska Health Insurance Open Enrollment

Individual Health Insurance Supplemental Insurance GoldKey