Maximizing Value: How Asset Recovery Liquidators Can Transform Your Business?

When businesses face financial challenges or need to streamline operations, asset recovery liquidators often step in as unsung heroes. These professionals specialize in identifying, valuing, and selling underutilized or surplus assets, helping businesses recover maximum value from items they no longer need. Whether it’s outdated machinery, excess inventory, or unused office equipment, asset recovery liquidators play a pivotal role in turning stagnant assets into liquid capital. This process not only boosts cash flow but also contributes to sustainability by ensuring that resources are reused rather than wasted. In today’s fast-paced business environment, leveraging the expertise of asset recovery liquidators can be a game-changer for companies looking to optimize their resources.

Asset recovery liquidators operate across a variety of industries, from manufacturing to retail and beyond. They employ a combination of market knowledge, valuation expertise, and strategic marketing to ensure that assets are sold at the best possible price. Their services are particularly valuable during periods of restructuring, mergers, or downsizing when businesses need to quickly convert physical assets into financial liquidity. By partnering with reputable asset recovery liquidators, organizations can minimize losses and focus on their core operations without the burden of managing surplus inventory or obsolete equipment.

Understanding the role of asset recovery liquidators is crucial for businesses aiming to stay competitive and agile. These professionals not only facilitate the sale of assets but also provide insights into market trends, helping businesses make informed decisions about asset management. In an era where efficiency and sustainability are paramount, asset recovery liquidators offer a practical solution for companies seeking to maximize their return on investment while contributing to a circular economy. Let’s delve deeper into how these experts operate and the value they bring to businesses of all sizes.

Read also:Tiffani Faison Face Surgery The Complete Story Behind Her Transformation

Table of Contents

- What Are Asset Recovery Liquidators?

- How Do Asset Recovery Liquidators Work?

- Why Should Businesses Choose Asset Recovery Liquidators?

- What Are the Benefits of Asset Recovery Liquidation?

- How to Find the Right Asset Recovery Liquidator?

- Common Challenges in Asset Recovery Liquidation

- What Industries Benefit Most from Asset Recovery Liquidators?

- Frequently Asked Questions

What Are Asset Recovery Liquidators?

Asset recovery liquidators are professionals or firms that specialize in helping businesses sell surplus, obsolete, or underutilized assets. These assets can range from machinery and equipment to office furniture and inventory. The primary goal of asset recovery liquidators is to recover as much value as possible from these items, which might otherwise sit idle or be discarded. By doing so, they provide businesses with much-needed liquidity while also promoting sustainability by ensuring that resources are reused.

These experts use a variety of methods to sell assets, including online auctions, private sales, and bulk transactions. Their approach is tailored to the specific needs of the business and the type of assets being liquidated. For instance, high-value machinery might be sold through targeted marketing to industry buyers, while smaller items like office supplies could be sold in bulk to wholesalers. This flexibility allows asset recovery liquidators to maximize returns for their clients.

Beyond just selling assets, these professionals also offer advisory services to help businesses better manage their resources. They analyze asset utilization patterns, recommend strategies for reducing waste, and provide insights into market trends. This holistic approach ensures that businesses not only recover value from their current surplus but also avoid accumulating unnecessary assets in the future.

How Do Asset Recovery Liquidators Work?

Understanding the process that asset recovery liquidators follow can help businesses appreciate the value they bring. The process typically involves several key steps, each designed to ensure maximum efficiency and profitability.

Step 1: Assessment and Valuation

The first step in the asset recovery process is a thorough assessment and valuation of the assets. Liquidators conduct a detailed inventory to determine the type, condition, and quantity of items available for sale. They then use their expertise to assign a fair market value to each item, taking into account factors like age, condition, and demand in the current market.

Accurate valuation is critical because it sets the foundation for the entire liquidation process. Overvaluing assets can lead to unsold inventory, while undervaluing them can result in lost revenue. Asset recovery liquidators often use a combination of historical data, market analysis, and industry knowledge to arrive at the most accurate valuation possible.

Read also:Discover The Hottest Female Athletes Inspiring Stories Achievements And More

Step 2: Marketing and Sales Strategy

Once the assets have been assessed and valued, the next step is to develop a marketing and sales strategy. This involves identifying the most effective channels for reaching potential buyers and creating targeted campaigns to generate interest. For example, industrial equipment might be marketed to manufacturers through industry-specific platforms, while office furniture could be sold to small businesses through online marketplaces.

Asset recovery liquidators also leverage technology to streamline the sales process. Online auctions, for instance, have become a popular method for selling assets quickly and efficiently. These platforms allow buyers from around the world to bid on items, increasing competition and driving up prices. Additionally, liquidators may use social media, email campaigns, and other digital tools to reach a wider audience.

Why Should Businesses Choose Asset Recovery Liquidators?

There are several compelling reasons why businesses should consider partnering with asset recovery liquidators. First and foremost, these professionals offer expertise that most businesses lack internally. They have a deep understanding of market dynamics, pricing strategies, and buyer behavior, which allows them to achieve better outcomes than businesses attempting to liquidate assets on their own.

Another key advantage is the time and effort saved. Liquidating assets can be a time-consuming process, especially for businesses without the necessary resources or experience. Asset recovery liquidators handle every aspect of the process, from valuation to marketing to final sales, allowing businesses to focus on their core operations. This is particularly valuable during periods of restructuring or financial distress when time is of the essence.

Finally, partnering with asset recovery liquidators can enhance sustainability efforts. By ensuring that surplus assets are reused or repurposed, businesses contribute to a circular economy and reduce their environmental footprint. This aligns with growing consumer demand for sustainable practices and can enhance a company’s reputation in the marketplace.

What Are the Benefits of Asset Recovery Liquidation?

Asset recovery liquidation offers numerous benefits that extend beyond simply generating cash. One of the most significant advantages is improved cash flow. By converting idle assets into liquid capital, businesses can reinvest in growth opportunities, pay off debts, or fund day-to-day operations. This influx of cash can be particularly valuable during challenging economic times or when unexpected expenses arise.

Another benefit is the reduction of storage and maintenance costs. Storing surplus inventory or unused equipment can be expensive, especially for businesses with limited space. By liquidating these assets, companies can free up valuable real estate and reduce overhead expenses. Additionally, they eliminate the need for ongoing maintenance, which can further reduce costs.

Asset recovery liquidation also promotes operational efficiency. By regularly reviewing and liquidating underutilized assets, businesses can streamline their operations and focus on their core competencies. This not only improves productivity but also enhances overall profitability. Moreover, the process provides valuable insights into asset utilization patterns, helping businesses make more informed decisions in the future.

How to Find the Right Asset Recovery Liquidator?

Choosing the right asset recovery liquidator is crucial for achieving the best possible outcomes. Businesses should start by conducting thorough research to identify reputable firms with a proven track record. Online reviews, testimonials, and case studies can provide valuable insights into a liquidator’s capabilities and reliability.

It’s also important to evaluate the liquidator’s expertise in the specific industry or asset category. For example, a firm that specializes in industrial equipment may not be the best choice for liquidating office furniture. Businesses should look for liquidators with experience in their particular field, as this ensures a deeper understanding of market dynamics and buyer preferences.

Finally, businesses should consider the liquidator’s approach to transparency and communication. A good liquidator will provide regular updates, clear documentation, and detailed reports throughout the process. This level of transparency builds trust and ensures that businesses are fully informed at every stage of the liquidation process.

Common Challenges in Asset Recovery Liquidation

While asset recovery liquidation offers numerous benefits, it is not without its challenges. Understanding these challenges can help businesses prepare and mitigate potential risks.

Challenge 1: Accurate Valuation

One of the most common challenges in asset recovery liquidation is accurately valuing assets. This requires a deep understanding of market conditions, buyer behavior, and asset depreciation. Overvaluing assets can lead to unsold inventory, while undervaluing them can result in significant financial losses. To overcome this challenge, businesses should work with experienced liquidators who use data-driven approaches to valuation.

Challenge 2: Market Fluctuations

Market conditions can change rapidly, impacting the demand for certain assets and their resale value. For example, economic downturns may reduce buyer interest, while technological advancements can render certain equipment obsolete. To mitigate this risk, businesses should time their liquidation efforts strategically and stay informed about market trends.

What Industries Benefit Most from Asset Recovery Liquidators?

While asset recovery liquidators can benefit businesses across various industries, some sectors stand to gain more than others. Manufacturing companies, for instance, often deal with surplus machinery and equipment, making them ideal candidates for asset recovery services. Similarly, retail businesses frequently need to liquidate excess inventory, especially during seasonal transitions or when discontinuing product lines.

Healthcare and technology industries also benefit significantly from asset recovery liquidators. Hospitals and clinics often have outdated medical equipment that can be sold to other facilities or repurposed. Meanwhile, tech companies frequently upgrade their hardware, creating opportunities to liquidate older models. By partnering with asset recovery liquidators, businesses in these industries can recover value from assets that would otherwise go to waste.

Frequently Asked Questions

What types of assets can asset recovery liquidators handle?

Asset recovery liquidators can handle a wide range of assets, including machinery, equipment, inventory, office furniture, and even intellectual property. Their expertise allows them to manage assets across various industries, ensuring maximum value recovery.

How long does the asset recovery process take?

The duration of the asset recovery process depends on several factors, including the type and quantity of assets, market conditions, and the chosen sales strategy. On average, the process can take anywhere from a few weeks to several months.

Can businesses liquidate assets on their own?

While businesses can attempt to liquidate assets on their own, partnering with professional asset recovery liquidators often yields better results. These experts bring market knowledge, valuation expertise, and strategic marketing capabilities that most businesses lack internally.

In conclusion, asset recovery liquidators play a vital role in helping businesses maximize the value of their surplus assets. By understanding their process, benefits, and challenges, businesses can make informed decisions about leveraging these services to improve cash flow, reduce costs, and enhance sustainability. Whether you’re in manufacturing, retail, or healthcare, asset recovery liquidators offer a practical solution for turning idle assets into valuable resources. For more insights into asset management strategies, check out this comprehensive guide on asset recovery.

What Happened To Kim Carnes Voice: The Untold Story

How To Cook Spaghetti Squash: A Complete Guide To Perfect Results

The Ultimate Guide To The Scariest Pictures Ever Captured

Proper Distraction In OCD Recovery You Have OCD

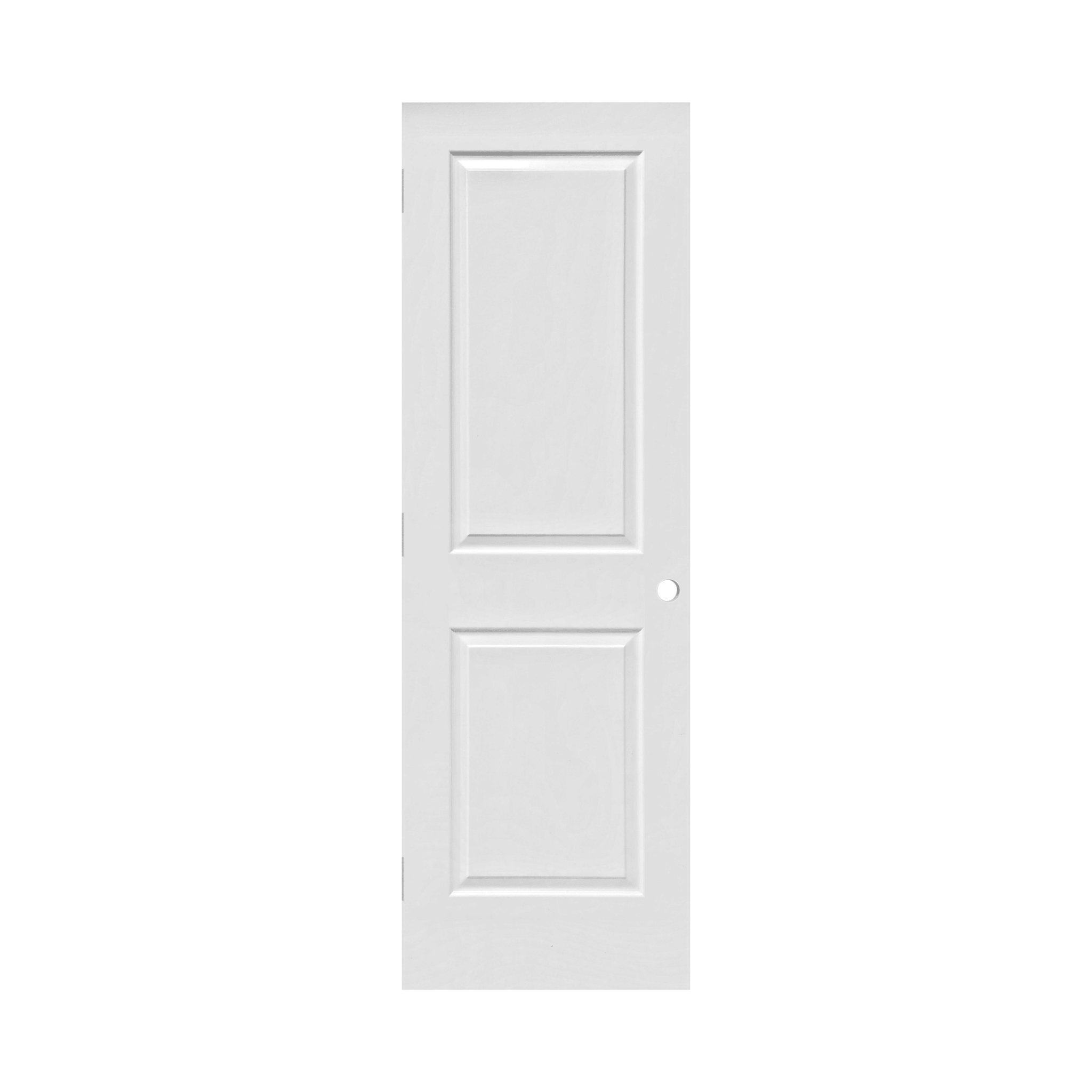

2 PANEL SQUARE HOLLOW DOOR PRE MACHINED 26" X 80" X 1 3/8" RIGHT HAND ☑