What Type Of Insurance Is Aflac? Everything You Need To Know

Aflac, short for American Family Life Assurance Company, is a well-known name in the insurance industry, offering a range of supplemental insurance products. These policies are designed to provide financial support when unforeseen medical expenses or life events arise. Unlike traditional health insurance, Aflac focuses on filling the gaps left by primary coverage, ensuring policyholders have peace of mind when facing unexpected challenges. While many people associate insurance with health or life coverage, Aflac’s offerings are unique. They specialize in supplemental insurance, which includes policies like accident insurance, critical illness insurance, and cancer insurance. These plans pay cash benefits directly to policyholders, helping them cover out-of-pocket expenses that primary insurance might not address. Whether it’s paying for hospital stays, treatments, or even daily living expenses during recovery, Aflac’s insurance products are tailored to offer financial flexibility when it’s needed most. In today’s unpredictable world, understanding what type of insurance Aflac provides can make a significant difference in your financial preparedness. This article dives deep into Aflac’s insurance offerings, their benefits, and how they compare to other types of insurance. By the end of this guide, you’ll have a clear understanding of whether Aflac’s policies align with your needs and how they can complement your existing coverage.

- What Type of Insurance is Aflac?

- How Does Aflac Insurance Work?

- What Are the Benefits of Aflac Insurance?

- Is Aflac Right for You?

- How Does Aflac Compare to Other Insurance Providers?

- What Are the Different Types of Aflac Policies Available?

- How to Choose the Best Aflac Policy for Your Needs

- Frequently Asked Questions About Aflac Insurance

What Type of Insurance is Aflac?

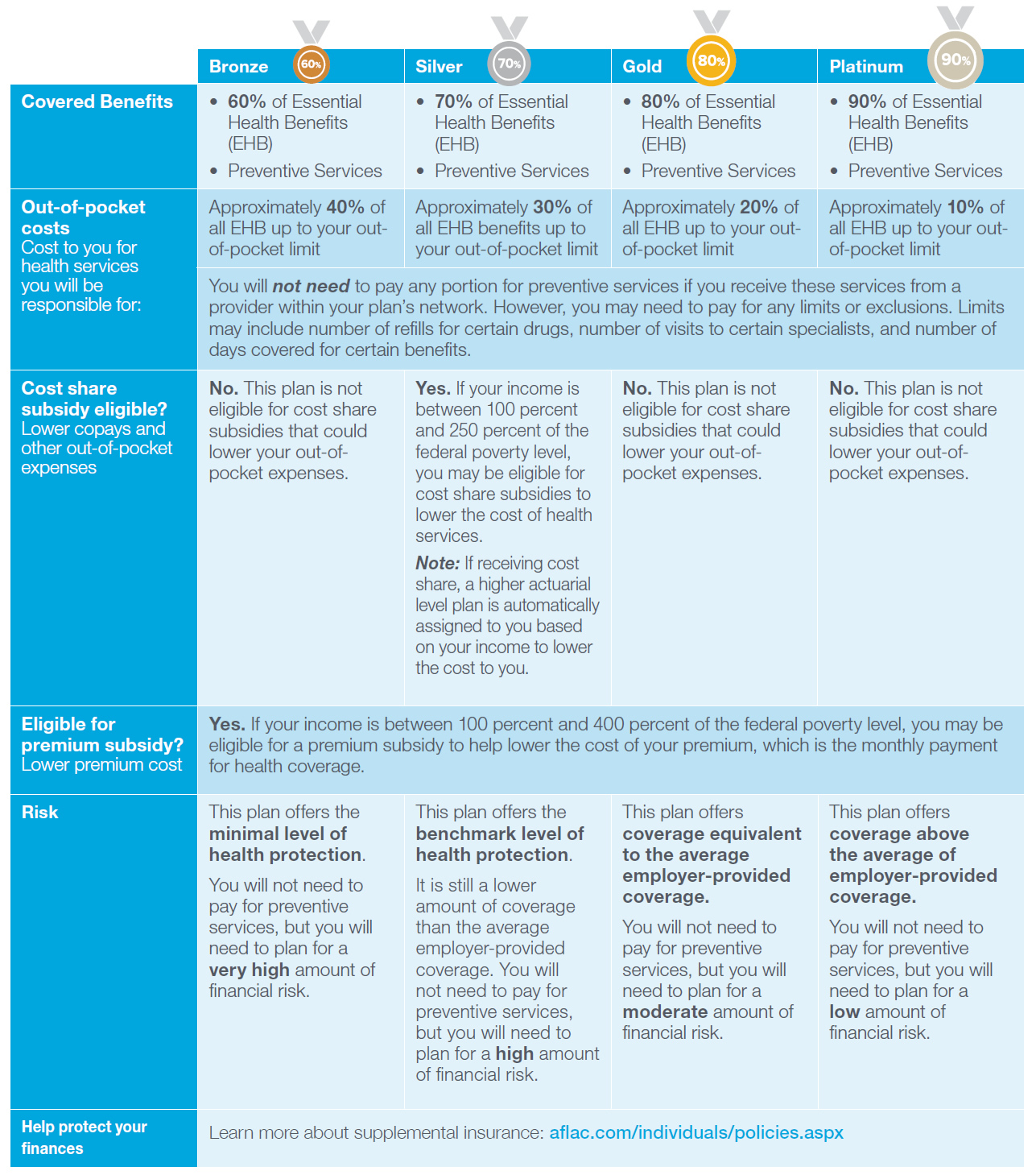

Aflac is primarily known for offering supplemental insurance, a category that complements traditional health, life, and disability insurance. Supplemental insurance is designed to provide additional financial support when primary insurance falls short. Aflac’s policies focus on paying cash benefits directly to policyholders, allowing them to use the funds however they see fit. This flexibility is one of the key reasons why Aflac has become a popular choice for individuals and families seeking extra financial security. The company offers a variety of plans, including accident insurance, critical illness insurance, and cancer insurance. Accident insurance provides benefits for unexpected injuries resulting from accidents, covering costs like hospital stays, surgeries, and even transportation to medical facilities. Critical illness insurance, on the other hand, offers lump-sum payments for serious health conditions such as heart attacks, strokes, or cancer diagnoses. This ensures that policyholders can focus on recovery without worrying about the financial burden. Cancer insurance is another standout product, specifically designed to help cover the costs associated with cancer treatments, including chemotherapy, radiation, and hospital stays. Aflac’s insurance is unique because it operates on a pay-for-what-you-need model. Unlike traditional health insurance, which often involves complex deductibles and co-pays, Aflac’s policies are straightforward and predictable. For example, if you’re hospitalized due to a covered accident or illness, Aflac will pay a predetermined amount directly to you, regardless of what your primary insurance covers. This makes Aflac an excellent choice for those who want to ensure they have financial protection against life’s uncertainties.

How Does Supplemental Insurance Differ from Traditional Insurance?

Supplemental insurance, like what Aflac offers, differs significantly from traditional insurance in several ways. Traditional insurance, such as health or life insurance, typically covers medical expenses or provides a death benefit. Supplemental insurance, however, is designed to fill the gaps left by primary coverage. For instance, while health insurance may cover a portion of hospital bills, supplemental insurance can help pay for ancillary costs like transportation, lodging, or even lost income during recovery.

Read also:Who Is Itslexismith Discover The Rising Star And Her Inspiring Journey

Why Choose Aflac Over Other Supplemental Insurance Providers?

Aflac stands out in the supplemental insurance market due to its extensive product range, customer-centric approach, and financial stability. The company has been in business for over 70 years, earning a reputation for reliability and trustworthiness. Additionally, Aflac’s policies are customizable, allowing policyholders to tailor coverage to their specific needs.

How Does Aflac Insurance Work?

Understanding how Aflac insurance works is crucial for making an informed decision about whether it’s the right choice for you. Aflac operates on a simple yet effective model: when a covered event occurs, such as an accident or a critical illness diagnosis, the policyholder files a claim. Once the claim is approved, Aflac pays the benefits directly to the policyholder, rather than to healthcare providers or hospitals. This direct payment structure is one of the defining features of Aflac’s insurance products. The claims process is straightforward and user-friendly. Policyholders can file claims online, through Aflac’s mobile app, or by mailing in the necessary documentation. Aflac is known for its quick claims processing, often approving and disbursing funds within a few days. This efficiency is particularly beneficial during emergencies when immediate financial support is needed. For example, if you’re hospitalized due to a covered accident, Aflac will send you a check to help cover expenses like deductibles, co-pays, or even everyday living costs while you recover. Another key aspect of how Aflac insurance works is its flexibility. Unlike traditional insurance, which often has strict guidelines on how benefits can be used, Aflac allows policyholders to allocate funds as they see fit. Whether it’s paying for medical bills, covering rent, or even taking time off work, the cash benefits provided by Aflac give policyholders the freedom to prioritize their needs. This flexibility makes Aflac an attractive option for individuals and families seeking financial peace of mind in uncertain times.

What Are the Steps to File a Claim with Aflac?

Filing a claim with Aflac is a hassle-free process designed to ensure policyholders receive their benefits quickly. Here are the steps involved: 1. **Gather Necessary Documentation**: Collect all relevant documents, such as medical bills, diagnosis reports, or accident reports, depending on the type of claim. 2. **Submit Your Claim**: File your claim online through Aflac’s website or mobile app, or mail the documents to their claims department. 3. **Track Your Claim**: Use Aflac’s online portal to monitor the status of your claim in real-time. 4. **Receive Your Benefits**: Once approved, Aflac will send the payment directly to you, either via check or direct deposit.

How Long Does It Take to Process a Claim?

Aflac is renowned for its efficient claims processing, with most claims being approved and paid within 3-5 business days. However, the exact timeline may vary depending on the complexity of the claim and the completeness of the submitted documentation.

What Are the Benefits of Aflac Insurance?

Aflac insurance offers numerous benefits that make it a valuable addition to your financial safety net. One of the most significant advantages is the cash benefits provided directly to policyholders. Unlike traditional insurance, which reimburses healthcare providers, Aflac’s policies give you the freedom to use the funds however you see fit. Whether it’s paying for medical expenses, covering daily living costs, or even taking a much-needed break during recovery, the flexibility of Aflac’s benefits is unmatched. Another key benefit of Aflac insurance is its ability to complement existing coverage. Many people find that their primary health insurance doesn’t cover all expenses, leaving them with significant out-of-pocket costs. Aflac’s supplemental policies bridge this gap by providing additional financial support for unexpected medical events. For instance, if you’re diagnosed with a critical illness, Aflac’s critical illness insurance can provide a lump-sum payment to help cover treatment costs, travel expenses, or even lost income during recovery. Aflac also stands out for its customer-centric approach and financial stability. The company has been in business for over seven decades and maintains a strong reputation for reliability. Additionally, Aflac’s policies are customizable, allowing you to tailor coverage to your specific needs. Whether you’re looking for accident insurance, cancer insurance, or critical illness coverage, Aflac offers a range of options to suit different lifestyles and budgets.

Why Should You Consider Aflac Insurance Over Other Options?

When comparing Aflac to other supplemental insurance providers, several factors make it a standout choice. First, Aflac’s extensive product range ensures that you can find a policy that aligns with your unique needs. Second, the company’s quick claims processing and user-friendly filing system make it easy to access your benefits when you need them most. Lastly, Aflac’s financial stability and long-standing reputation provide peace of mind, knowing that your coverage is backed by a trusted name in the industry.

Read also:Everything You Need To Know About Wwwmcdvoicecom The Ultimate Guide

How Does Aflac’s Customer Service Enhance the Policyholder Experience?

Aflac’s commitment to customer service is another significant benefit. The company offers 24/7 support, ensuring that policyholders can get assistance whenever they need it. Whether you’re filing a claim, updating your policy, or simply have questions about your coverage, Aflac’s dedicated team is available to help.

Is Aflac Right for You?

Deciding whether Aflac is the right insurance provider for you depends on several factors, including your current coverage, financial goals, and personal needs. Aflac’s supplemental insurance is particularly beneficial for individuals who already have primary health insurance but want additional financial protection against unexpected medical events. If you’re someone who values flexibility and peace of mind, Aflac’s cash benefits and customizable policies could be an excellent fit. To determine if Aflac is right for you, consider your existing insurance coverage. Do you have gaps in your health or life insurance that leave you vulnerable to out-of-pocket expenses? Aflac’s supplemental policies can help fill those gaps, providing financial support for accidents, critical illnesses, and cancer treatments. For example, if your primary insurance has high deductibles or co-pays, Aflac’s benefits can help cover those costs, reducing your financial burden during challenging times. Another important factor to consider is your budget. Aflac’s policies are designed to be affordable, with premiums that can be tailored to fit your financial situation. By choosing the right coverage levels and options, you can ensure that your Aflac policy provides maximum value without straining your finances. Additionally, Aflac’s customizable plans allow you to adjust your coverage as your needs change, ensuring that your policy remains relevant and effective over time.

How to Evaluate Your Insurance Needs Before Choosing Aflac?

Before deciding on Aflac, take the time to evaluate your insurance needs thoroughly. Here are some questions to guide your decision-making process: 1. **What Gaps Exist in My Current Coverage?** Identify areas where your primary insurance may fall short, such as high deductibles or limited coverage for specific conditions. 2. **What Are My Financial Priorities?** Consider how much you can afford to spend on premiums and what level of financial protection you need. 3. **What Types of Risks Am I Most Concerned About?** Determine which unexpected events, such as accidents or critical illnesses, would have the most significant impact on your financial stability.

What Are the Potential Drawbacks of Aflac Insurance?

While Aflac offers many benefits, it’s essential to be aware of potential drawbacks. For instance, supplemental insurance is not a replacement for primary health insurance, so it’s crucial to have adequate coverage in place before considering Aflac. Additionally, some policies may have limitations or exclusions, so it’s important to read the fine print and understand the terms of your coverage.

How Does Aflac Compare to Other Insurance Providers?

When comparing Aflac to other insurance providers, several factors set it apart from the competition. Aflac specializes in supplemental insurance, a niche that many traditional insurance companies don’t fully address. While companies like MetLife and Prudential offer similar products, Aflac’s extensive range of policies and customer-centric approach make it a standout choice. For example, Aflac’s accident insurance, critical illness insurance, and cancer insurance are specifically designed to provide financial support when primary insurance falls short. Another key differentiator is Aflac’s claims process. Unlike some providers that take weeks to process claims, Aflac is known for its efficiency, often disbursing benefits within a few days. This quick turnaround is particularly valuable during emergencies when immediate financial support is needed. Additionally, Aflac’s user-friendly online portal and mobile app make it easy for policyholders to file claims, track their status, and manage their policies. Financial stability is another area where Aflac excels. With over 70 years in business, the company has built a reputation for reliability and trustworthiness. This is reflected in its strong

Understanding Race Vs. Ethnicity: A Comprehensive Guide

Exploring The Thrilling Universe Of Games With Virtual Worlds

Discovering The Charm Of Salem: The Capital Of Oregon And Its Rich Heritage

Aflac Home Insurance Reviews Homemade Ftempo

Aflac investors Atheios