Understanding Nebraska Health Coverage: A Comprehensive Guide

Nebraska health coverage plays a pivotal role in ensuring residents have access to affordable and quality healthcare services. Whether you’re a long-time resident or new to the state, understanding the ins and outs of health coverage can seem daunting. From Medicaid programs to private insurance options, Nebraska offers a variety of resources to meet the diverse needs of its population. Navigating these options is crucial for safeguarding your health and financial well-being.

In recent years, Nebraska has taken significant steps to expand its healthcare offerings, particularly through Medicaid expansion and partnerships with federal programs. These initiatives aim to make healthcare more accessible and affordable for low-income families, seniors, and individuals with pre-existing conditions. With healthcare being a cornerstone of personal and community health, it’s essential to stay informed about the programs available to you.

This guide will walk you through the various aspects of Nebraska health coverage, including eligibility requirements, benefits, and enrollment processes. By the end, you’ll have a clear understanding of how to access the care you need and the tools to make informed decisions about your health. Let’s dive into the details and explore what Nebraska has to offer in terms of healthcare solutions.

Read also:Chadwick Boseman Wife A Glimpse Into His Life And Legacy

Table of Contents

- What Is Nebraska Health Coverage?

- How Does Medicaid Work in Nebraska?

- What Are the Private Insurance Options in Nebraska?

- How to Apply for Health Coverage in Nebraska

- What Are the Benefits of Nebraska Health Programs?

- How Can Small Businesses Access Health Coverage in Nebraska?

- What Support Services Are Available for Nebraska Residents?

- FAQs About Nebraska Health Coverage

What Is Nebraska Health Coverage?

Nebraska health coverage encompasses a range of programs and services designed to ensure residents have access to affordable and quality healthcare. These programs are administered through a combination of state and federal initiatives, including Medicaid, the Children’s Health Insurance Program (CHIP), and private insurance options. Understanding the landscape of health coverage in Nebraska is essential for making informed decisions about your healthcare needs.

One of the key components of Nebraska health coverage is Medicaid, a joint federal and state program that provides health insurance to low-income individuals and families. In 2020, Nebraska expanded its Medicaid program under the Affordable Care Act, allowing more residents to qualify for benefits. This expansion has significantly increased access to healthcare services for vulnerable populations, including seniors, children, and individuals with disabilities.

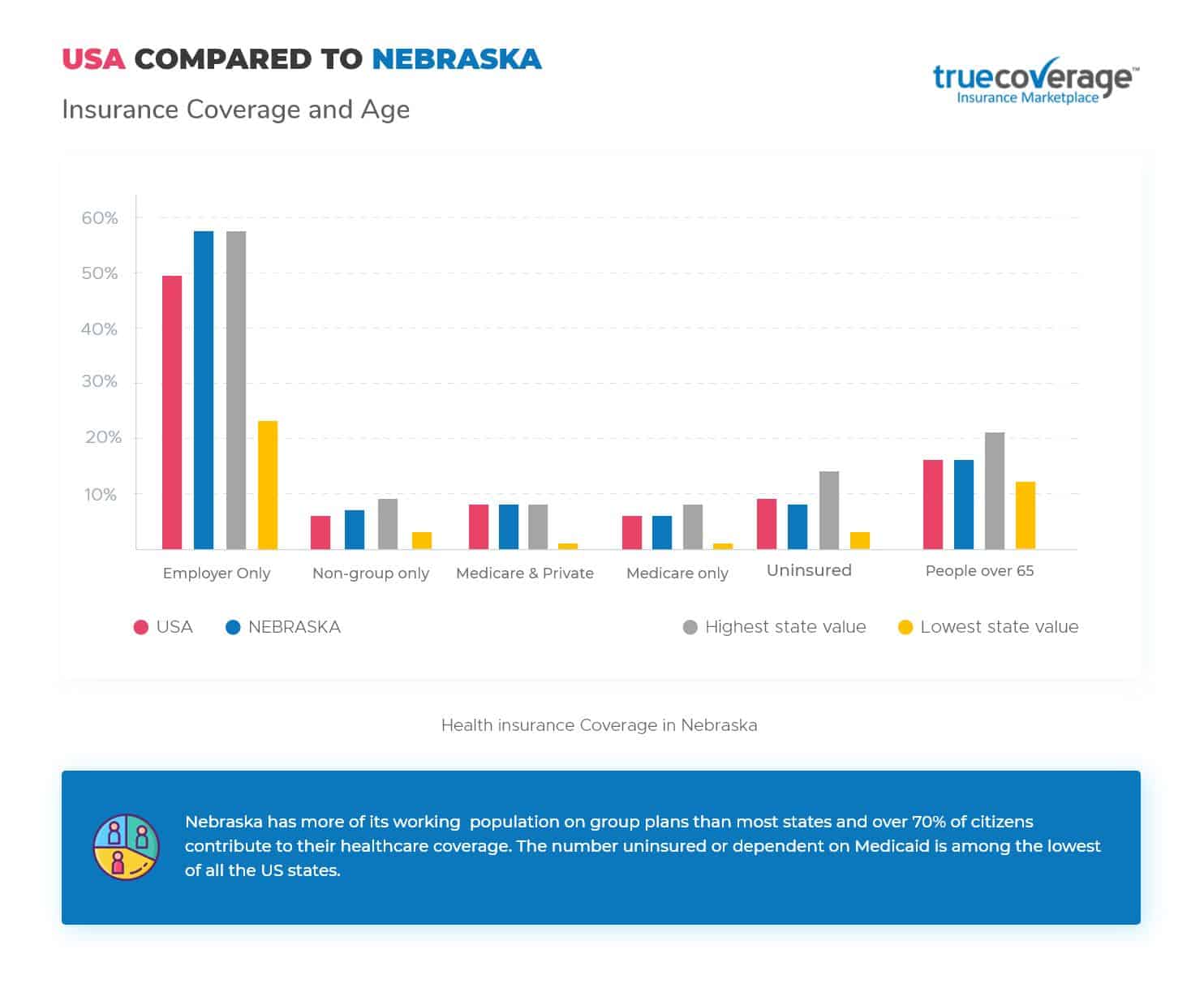

Beyond Medicaid, Nebraska residents can explore private insurance options through the Health Insurance Marketplace. These plans offer varying levels of coverage, from basic to comprehensive, and are often subsidized based on income. Whether you’re self-employed, unemployed, or employed by a company that doesn’t offer health benefits, the marketplace provides a flexible way to secure coverage. Additionally, employer-sponsored plans remain a popular choice for many residents, offering group rates and additional benefits.

How Does Medicaid Expansion Impact Nebraska Residents?

Medicaid expansion has been a game-changer for Nebraska health coverage, particularly for individuals and families earning up to 138% of the federal poverty level. This initiative has opened doors for thousands of residents who previously fell into the "coverage gap," meaning they earned too much to qualify for traditional Medicaid but too little to afford private insurance. The expansion has also helped reduce the financial burden of healthcare costs, allowing more people to seek preventive care and manage chronic conditions.

What Role Does the Health Insurance Marketplace Play in Nebraska?

The Health Insurance Marketplace serves as a one-stop shop for individuals and families seeking private insurance options. Through the marketplace, residents can compare plans, apply for subsidies, and enroll in coverage that suits their needs. Open enrollment periods typically occur once a year, but special enrollment periods are available for qualifying life events such as marriage, childbirth, or loss of other coverage. Navigating the marketplace can be simplified with the help of certified enrollment counselors or online tools.

How Does Medicaid Work in Nebraska?

Medicaid is a cornerstone of Nebraska health coverage, providing essential services to low-income residents. The program is funded jointly by the federal and state governments and is administered by the Nebraska Department of Health and Human Services (DHHS). Eligibility for Medicaid is based on income, household size, and other factors, such as age, disability status, and pregnancy.

Read also:Who Is Livvy Dunne Discover The Rising Star In Gymnastics

In Nebraska, Medicaid covers a wide range of services, including doctor visits, hospital stays, prescription medications, and preventive care. Beneficiaries also have access to specialized programs, such as behavioral health services and long-term care. The state’s Medicaid program is designed to be comprehensive, ensuring that enrollees receive the care they need to maintain their health and well-being.

What Are the Eligibility Requirements for Medicaid in Nebraska?

To qualify for Medicaid in Nebraska, applicants must meet specific income and residency requirements. For example, adults without dependent children may qualify if their income is at or below 138% of the federal poverty level. Pregnant women, children, and individuals with disabilities may have higher income thresholds. Additionally, applicants must be U.S. citizens or qualified non-citizens and reside in Nebraska.

How Can Residents Apply for Medicaid in Nebraska?

Applying for Medicaid in Nebraska is a straightforward process. Residents can apply online through the ACCESS Nebraska portal, by mail, or in person at a local DHHS office. The application requires documentation of income, household size, and other relevant information. Once approved, beneficiaries receive an identification card and can begin accessing covered services through participating providers.

What Are the Private Insurance Options in Nebraska?

Private insurance is another critical component of Nebraska health coverage, offering flexibility and choice for individuals and families. These plans are available through the Health Insurance Marketplace, employer-sponsored programs, and direct purchases from insurance companies. Private insurance options vary in terms of cost, coverage levels, and network restrictions, allowing consumers to tailor their plans to their specific needs.

One of the advantages of private insurance is the ability to choose from different types of plans, such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and High Deductible Health Plans (HDHPs). Each plan type has its own set of benefits and limitations, so it’s important to carefully review the details before enrolling. For example, HMOs typically require enrollees to use in-network providers, while PPOs offer more flexibility but may come with higher premiums.

What Are the Costs Associated with Private Insurance in Nebraska?

The cost of private insurance in Nebraska depends on several factors, including age, location, tobacco use, and the level of coverage selected. Premiums, deductibles, and out-of-pocket maximums can vary significantly between plans. However, financial assistance is available for eligible individuals through premium tax credits and cost-sharing reductions. These subsidies are designed to make coverage more affordable for low- and middle-income residents.

How Do Employer-Sponsored Plans Compare to Marketplace Options?

Employer-sponsored plans are often more affordable than marketplace options because employers typically cover a portion of the premium costs. These plans may also offer additional benefits, such as dental and vision coverage, wellness programs, and retirement savings plans. However, not all employers provide health insurance, and some employees may find marketplace plans more suitable for their needs. Comparing options side-by-side is essential for making the best decision.

How to Apply for Health Coverage in Nebraska

Applying for health coverage in Nebraska is a multi-step process that requires careful attention to detail. Whether you’re applying for Medicaid, enrolling in a marketplace plan, or exploring employer-sponsored options, understanding the steps involved can help streamline the process and ensure you receive the benefits you’re eligible for.

The first step is to determine which programs you qualify for based on your income, household size, and other factors. For Medicaid, you can use the ACCESS Nebraska portal to complete an application online. If you’re applying for a marketplace plan, visit Healthcare.gov during the open enrollment period or a special enrollment period if you qualify. Employer-sponsored plans typically require enrollment during specific times, so check with your HR department for details.

What Documents Are Needed to Apply for Health Coverage?

Gathering the necessary documents before starting your application can save time and reduce stress. Common documents include proof of income (such as pay stubs or tax returns), identification (such as a driver’s license or Social Security card), and household information (such as the number of dependents). If you’re applying for Medicaid, you may also need to provide proof of residency and citizenship status.

How Can Enrollment Assistors Help with the Application Process?

Enrollment assistors, also known as navigators or certified application counselors, are trained professionals who can guide you through the application process. They can help you understand your options, complete paperwork, and resolve any issues that arise. Many assistors offer their services for free, making them a valuable resource for individuals and families navigating the complexities of Nebraska health coverage.

What Are the Benefits of Nebraska Health Programs?

Nebraska health programs offer a wide range of benefits designed to improve the health and well-being of residents. These programs not only provide access to essential medical services but also address social determinants of health, such as housing, nutrition, and transportation. By addressing these factors, Nebraska health programs aim to create a holistic approach to healthcare that supports individuals and communities.

One of the standout benefits of Nebraska health programs is the emphasis on preventive care. Regular check-ups, screenings, and vaccinations are covered under most plans, helping individuals detect and manage health issues before they become serious. Preventive care not only improves health outcomes but also reduces healthcare costs by avoiding costly treatments and hospitalizations.

What Support Services Are Available Through Medicaid?

Medicaid in Nebraska offers several support services beyond traditional medical care. For example, beneficiaries may have access to transportation assistance for medical appointments, home health services, and mental health counseling. These services are designed to remove barriers to care and ensure that all residents can access the resources they need to stay healthy.

How Do Health Programs Address Social Determinants of Health?

Addressing social determinants of health is a priority for Nebraska health programs. Initiatives such as housing assistance, nutrition education, and job training programs are often integrated into healthcare services. By tackling these underlying factors, Nebraska aims to create a healthier population and reduce disparities in healthcare access and outcomes.

How Can Small Businesses Access Health Coverage in Nebraska?

Small businesses in Nebraska face unique challenges when it comes to providing health coverage for their employees. However, several options are available to help small business owners offer affordable and comprehensive plans. From Small Business Health Options Program (SHOP) Marketplace plans to tax credits and private insurance, Nebraska offers a variety of solutions to meet the needs of small businesses.

One of the most popular options for small businesses is the SHOP Marketplace, which allows employers to compare and purchase group health insurance plans. These plans often come with tax advantages and can be customized to fit the needs of the business and its employees. Additionally, small businesses with fewer than 25 employees may qualify for the Small Business Health Care Tax Credit, which can significantly reduce the cost of providing coverage.

What Are the Advantages of Offering Health Coverage to Employees?

Offering health coverage can provide numerous benefits for small businesses, including improved employee retention, increased productivity, and a competitive edge in the job market. Employees who have access to health insurance are more likely to stay with their employer and report higher job satisfaction. Furthermore, providing health benefits can enhance the company’s reputation and attract top talent.

How Can Small Businesses Navigate the SHOP Marketplace?

Navigating the SHOP Marketplace can be simplified with the help of certified brokers or enrollment assistors. These professionals can help small business owners compare plans, estimate costs, and complete the enrollment process. Additionally, the marketplace offers tools and resources to guide employers through each step, ensuring they make informed decisions about their health coverage offerings.

What Support Services Are Available for Nebraska Residents?

Nebraska residents have access to a variety of support services to help them navigate the complexities of health coverage. These services are designed to assist individuals and families in understanding their options, applying for benefits, and resolving any issues that may arise. From enrollment assistors to community organizations, Nebraska offers a robust network of resources to support residents in achieving their healthcare goals.

One of the most valuable resources is the network of certified enrollment assistors available throughout the state. These professionals provide

What Is A Baby Donkey: A Complete Guide To Understanding These Adorable Creatures

Who Plays Quigley Down Under: Uncovering The Star Behind The Role

Dr. Frank Turek Net Worth: A Comprehensive Guide To His Achievements And Influence

Affordable Nebraska Health Insurance Open Enrollment

Harnessing Digital Technology for Universal Health Coverage In Nigeria