Understanding The UF Bookstore Line Of Credit: A Student's Guide

For students attending the University of Florida, managing finances while pursuing academic success can be challenging. One solution that has gained popularity is the UF Bookstore Line of Credit, a financial tool designed specifically to assist students in covering their educational expenses. This line of credit offers a convenient way to purchase textbooks, supplies, and other essentials without the immediate financial strain. By providing a flexible payment option, it allows students to focus more on their studies and less on their budget constraints.

The UF Bookstore Line of Credit is not just another financial product; it is a lifeline for many students who find themselves juggling tuition fees, living expenses, and the ever-increasing costs of educational materials. With this line of credit, students can access funds to cover their bookstore purchases, which can be repaid over time. This system not only alleviates immediate financial pressures but also helps students build credit responsibly. Understanding how this line of credit works is crucial for making informed financial decisions that align with one's academic and personal goals.

As we delve deeper into the intricacies of the UF Bookstore Line of Credit, it's important to recognize its potential impact on a student's financial health. By exploring its benefits, eligibility criteria, and application process, students can make the most of this opportunity. Whether you're a freshman navigating the complexities of college life or a senior preparing for graduation, the UF Bookstore Line of Credit could be a valuable resource. In the following sections, we will address common questions, provide detailed insights, and offer practical advice to help you leverage this financial tool effectively.

Read also:Who Is Bryce Adams Ed Unveiling The Life And Achievements Of An Inspiring Educator

Table of Contents

- What is the UF Bookstore Line of Credit and How Does It Work?

- What Are the Eligibility Requirements for the UF Bookstore Line of Credit?

- How to Apply for the UF Bookstore Line of Credit?

- What Are the Benefits of Using the UF Bookstore Line of Credit?

- How Can Students Use the UF Bookstore Line of Credit Responsibly?

- Are There Alternatives to the UF Bookstore Line of Credit?

- Frequently Asked Questions About the UF Bookstore Line of Credit

- Conclusion: Making the Most of the UF Bookstore Line of Credit

What is the UF Bookstore Line of Credit and How Does It Work?

The UF Bookstore Line of Credit is a specialized financial service tailored to meet the needs of University of Florida students. This line of credit is designed to provide students with a pre-approved amount of funds that can be used exclusively at the UF Bookstore. Unlike traditional loans, this service offers flexibility and convenience, allowing students to purchase textbooks, supplies, and other necessary items without the immediate burden of full payment. The funds are typically available at the start of each semester, ensuring students have access to the resources they need to succeed academically.

So, how does this line of credit function in practice? Once approved, students can use their line of credit to make purchases directly at the UF Bookstore. The bookstore staff will process the transaction, deducting the amount from the student's available credit. Payments are usually scheduled in installments, allowing students to repay the borrowed amount over time. This structure not only simplifies budgeting but also helps students manage their finances more effectively. Additionally, the interest rates are often lower than those of credit cards, making it a cost-effective option for many.

One of the key features of the UF Bookstore Line of Credit is its integration with the university's financial system. This ensures seamless transactions and easy tracking of purchases and repayments. Students can monitor their credit usage and repayment schedule through their university account, providing transparency and control over their financial obligations. Furthermore, this line of credit is often bundled with other financial aid packages, offering a comprehensive solution for students seeking financial assistance. By understanding how the UF Bookstore Line of Credit operates, students can make informed decisions that support their academic journey.

What Are the Eligibility Requirements for the UF Bookstore Line of Credit?

Securing the UF Bookstore Line of Credit requires meeting specific eligibility criteria, which are designed to ensure that students can manage their financial responsibilities effectively. First and foremost, applicants must be currently enrolled students at the University of Florida. This requirement ensures that the line of credit is utilized for its intended purpose—supporting academic success. Additionally, students must demonstrate satisfactory academic progress, as defined by the university's standards, to qualify for this financial aid.

Financial Stability and Credit History

Financial stability is another critical factor in determining eligibility. While the UF Bookstore Line of Credit is more accessible than traditional loans, a basic credit check may still be conducted. This is not to discourage students but to ensure they have a foundational understanding of credit management. For those with limited credit history, having a co-signer, such as a parent or guardian, can strengthen the application. The co-signer's role is to provide additional assurance that the credit will be repaid according to the agreed terms.

Documentation and Application Process

Applicants must also provide necessary documentation to support their application. This typically includes proof of enrollment, identification, and sometimes proof of income or financial support. Gathering these documents in advance can streamline the application process, making it quicker and more efficient. It's also beneficial for students to review their financial situation and plan how they intend to repay the credit, as this foresight can enhance their eligibility and financial planning.

Read also:Who Is Livvy Dunne Discover The Rising Star In Gymnastics

Understanding these eligibility requirements is crucial for students considering the UF Bookstore Line of Credit. By meeting these criteria, students can access a valuable resource that supports their educational needs while fostering responsible financial habits. This line of credit is more than just a financial tool; it's an opportunity to build a solid foundation for future financial independence.

How to Apply for the UF Bookstore Line of Credit?

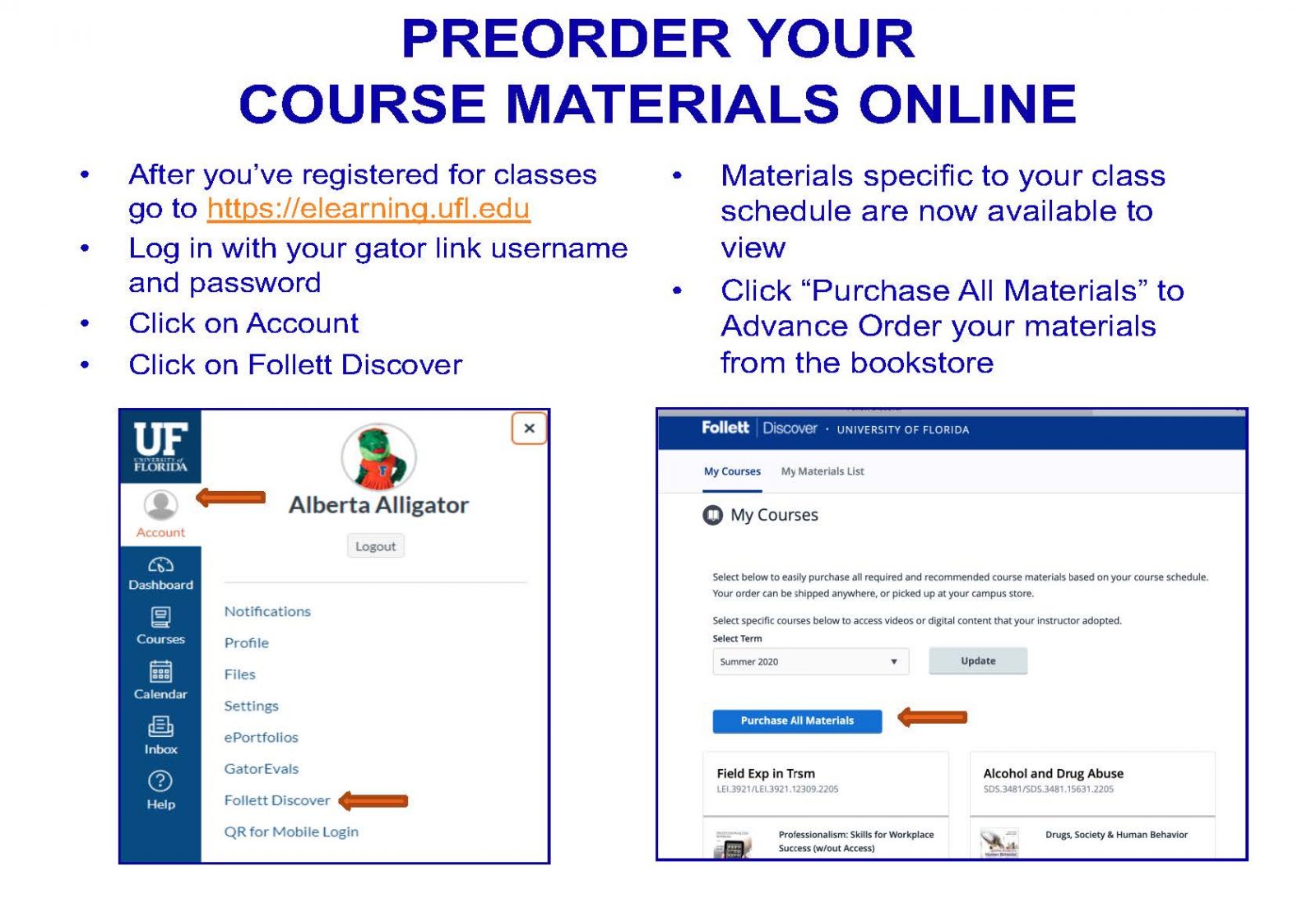

Applying for the UF Bookstore Line of Credit is a straightforward process, but it requires attention to detail and preparation. The first step is to visit the official University of Florida financial aid website, where you can find the application form specifically designed for this line of credit. Before diving into the application, ensure that you have all the necessary documents ready. These typically include your student ID, proof of enrollment, and any financial information that might be required. Having these documents on hand will make the process smoother and more efficient.

Completing the Application Form

Once you have your documents ready, you can begin filling out the application form. The form will ask for personal information, such as your name, address, and contact details, as well as academic information like your student ID and expected graduation date. It's crucial to double-check this information for accuracy, as any errors could delay the processing of your application. Additionally, you may be asked to provide details about your financial situation, including any existing financial aid or scholarships. This information helps the university assess your financial need and ability to repay the credit.

Submitting the Application and Next Steps

After completing the application form, review it thoroughly to ensure all sections are filled out correctly. Once satisfied, submit the form through the online portal. You may receive a confirmation email acknowledging receipt of your application. At this stage, it's important to monitor your email and university account for any updates or requests for additional information. The processing time can vary, but you can generally expect a response within a few weeks. If approved, you will receive details about your credit limit and how to access the funds. If your application is denied, don't be disheartened; you can seek feedback and explore other financial aid options available at the university.

By following these steps, you can navigate the application process for the UF Bookstore Line of Credit with confidence. Remember, preparation and attention to detail are key to a successful application. This line of credit can be a valuable resource in managing your educational expenses, so take the time to apply thoughtfully and thoroughly.

What Are the Benefits of Using the UF Bookstore Line of Credit?

The UF Bookstore Line of Credit offers a plethora of advantages that can significantly ease the financial burden on students. One of the most notable benefits is the convenience it provides. With this line of credit, students can purchase all their necessary textbooks and supplies at the start of the semester without worrying about the immediate financial impact. This ease of access ensures that students are well-equipped for their academic journey, allowing them to focus more on their studies and less on their financial constraints. Moreover, the line of credit is integrated directly with the university's financial system, making transactions seamless and hassle-free.

Financial Management and Budgeting

Another significant advantage is the ability to manage finances more effectively. The UF Bookstore Line of Credit allows students to spread out their payments over time, which can be particularly beneficial for those who might not have the means to pay for all their educational materials upfront. This installment plan helps students budget their money more efficiently, preventing the stress of large, lump-sum payments. Additionally, the interest rates associated with this line of credit are often lower than those of traditional credit cards, making it a more economical choice for students. By using this line of credit responsibly, students can also build a positive credit history, which is invaluable for their financial future.

Support for Academic Success

Beyond financial benefits, the UF Bookstore Line of Credit supports academic success by ensuring that students have access to all the resources they need. Whether it's purchasing the latest edition of a textbook or acquiring essential lab supplies, this line of credit ensures that no student is left behind due to financial limitations. Furthermore, it often comes bundled with other financial aid packages, providing a comprehensive support system for students. This holistic approach not only aids in academic achievement but also fosters a sense of financial independence and responsibility among students. By leveraging the UF Bookstore Line of Credit, students can make the most of their educational experience without compromising their financial stability.

How Can Students Use the UF Bookstore Line of Credit Responsibly?

Using the UF Bookstore Line of Credit responsibly is crucial for maintaining financial health and building a positive credit history. One of the first steps in responsible usage is understanding the terms and conditions associated with the line of credit. Students should familiarize themselves with the interest rates, repayment schedule, and any fees that may apply. This knowledge empowers students to make informed decisions about their purchases and ensures they are not caught off guard by unexpected costs. By staying informed, students can avoid overextending their credit and manage their financial obligations effectively.

Budgeting and Financial Planning

Creating a budget is another essential aspect of responsible credit usage. Students should assess their financial situation and determine how much they can afford to borrow and repay each month. This involves listing all sources of income and expenses, including tuition, rent, and other living costs. By setting a realistic budget, students can ensure they only use the line of credit for necessary purchases, such as textbooks and essential supplies. Additionally, tracking expenses and sticking to the budget can prevent overspending and help students maintain control over their finances. It's also wise to set aside a portion of any income for repayment, ensuring that the credit is paid off on time.

Building Credit and Financial Independence

Responsible use of the UF Bookstore Line of Credit can also contribute to building a strong credit history. Timely repayments and staying within the credit limit demonstrate financial responsibility, which can positively impact a student's credit score. This is particularly important for students who are just starting to establish their credit history. A good credit score can open doors to future financial opportunities, such as loans and credit cards with better terms. Moreover, using the line of credit responsibly fosters a sense of financial independence, teaching students valuable lessons about managing debt and making sound financial decisions. By leveraging the UF Bookstore Line of Credit wisely, students can lay the groundwork for a stable financial future.

Are There Alternatives to the UF Bookstore Line of Credit?

While the UF Bookstore Line of Credit is a popular choice for many students, it's important to explore other financial aid options that might better suit individual needs. Scholarships, for instance, are an excellent alternative as they do not require repayment and can significantly reduce the financial burden of educational expenses. Many organizations, both within and outside the university, offer scholarships based on academic merit, financial need, or specific talents. Students should actively seek out these opportunities and apply early to maximize their chances of receiving financial support.

Grants and Work-Study Programs

Grants are another viable option, often provided by the government or educational institutions to assist students with their educational costs. Unlike loans, grants do not need to be repaid, making them an attractive choice for students seeking financial aid. Additionally, work-study programs offer students the opportunity to earn money while gaining valuable work experience. These programs are typically available on campus and provide flexible hours that accommodate a student's academic schedule. By participating in a work-study program, students can earn a steady income to cover their expenses without relying solely on credit.

Personal Savings

What Is A Compound Bow? Everything You Need To Know

Exploring The World Of Tabletop Community Engagement: A Path To Connection And Creativity

The Scariest Image: Unveiling The Psychology And Impact Of Fear In Visuals

Bookstore Line of Credit Business Services Business Services

Bookstore Line of Credit Business Services Business Services