TSP Market Commentary: A Comprehensive Guide To Thriving In Today's Investment Landscape

Are you curious about the TSP market commentary and how it impacts your investments? In today’s ever-evolving financial world, understanding the nuances of the Thrift Savings Plan (TSP) is essential for maximizing returns and securing financial stability. TSP market commentary provides invaluable insights into market trends, economic shifts, and investment strategies, helping both novice and seasoned investors navigate the complexities of retirement planning. Whether you're a federal employee, a military member, or simply someone exploring retirement options, staying informed about the TSP market can make all the difference in achieving your financial goals.

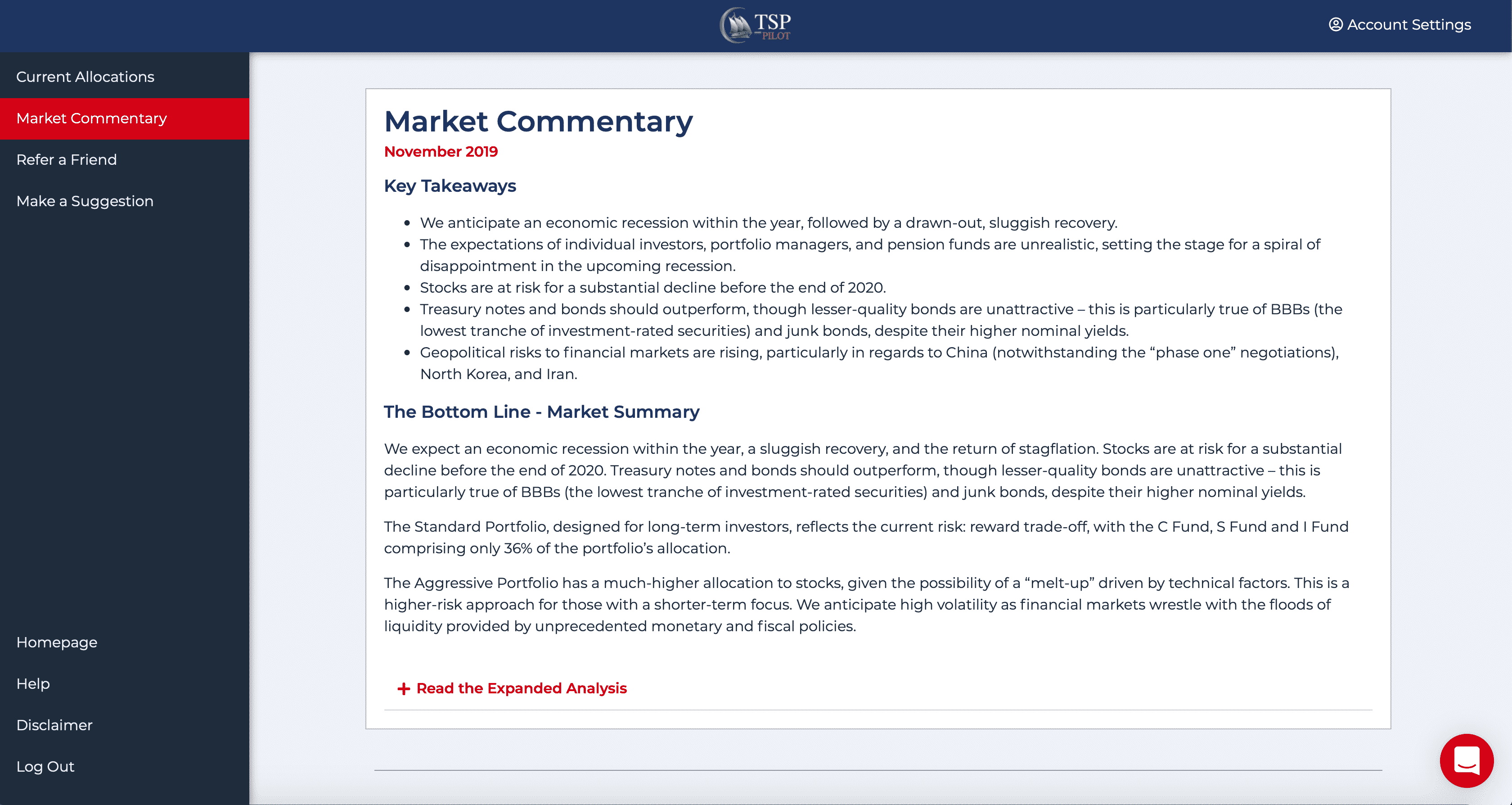

As the TSP continues to grow in popularity, market commentary becomes a critical tool for decision-making. With millions of participants relying on the TSP for their retirement savings, it’s no wonder that market trends and expert analysis are closely monitored. TSP market commentary offers a deep dive into factors such as fund performance, economic indicators, and geopolitical events that influence investment outcomes. By staying updated with market commentary, you can make informed decisions that align with your risk tolerance, financial goals, and long-term strategy.

But what exactly is TSP market commentary, and why is it so crucial? Essentially, it’s a detailed analysis of the TSP's performance and the broader market conditions that affect it. From stock market fluctuations to changes in interest rates, TSP market commentary helps investors understand the "why" behind market movements. With this knowledge, you can better position your portfolio to weather volatility and capitalize on growth opportunities. In this article, we’ll explore everything you need to know about TSP market commentary, including expert insights, actionable strategies, and answers to frequently asked questions.

Read also:Jlo And Diddy The Untold Story Of Their Dynamic Connection

Table of Contents

- What is TSP Market Commentary and Why Does It Matter?

- How Does TSP Market Commentary Impact Your Investment Strategy?

- Key Factors Influencing TSP Market Trends

- Is TSP Market Commentary Reliable for Long-Term Investors?

- What Are the Best Sources for TSP Market Commentary?

- Expert Tips for Interpreting TSP Market Commentary

- How to Use TSP Market Commentary for Retirement Planning

- Frequently Asked Questions About TSP Market Commentary

What is TSP Market Commentary and Why Does It Matter?

TSP market commentary refers to the analysis and interpretation of market trends and economic factors that influence the performance of the Thrift Savings Plan. This type of commentary is often provided by financial experts, investment analysts, and market researchers who specialize in understanding the nuances of retirement savings plans. By dissecting data and trends, TSP market commentary aims to provide actionable insights for investors who rely on the TSP for their retirement savings.

Why does TSP market commentary matter? For starters, it helps investors stay informed about the factors that could impact their portfolios. For instance, changes in interest rates, inflation rates, and geopolitical events can all influence the performance of TSP funds. By understanding these dynamics, investors can make informed decisions about their contributions, fund allocations, and withdrawal strategies. Moreover, TSP market commentary can serve as a reality check, helping investors avoid emotional decision-making during periods of market volatility.

Another reason TSP market commentary is crucial is its ability to provide a forward-looking perspective. While past performance is not always indicative of future results, market commentary often includes predictions and forecasts based on current trends. This can be particularly useful for long-term investors who want to align their portfolios with anticipated market movements. Whether you're adjusting your allocation to the G Fund for stability or exploring the potential of the C Fund for growth, TSP market commentary can guide you in making strategic decisions.

How Does TSP Market Commentary Impact Your Investment Strategy?

TSP market commentary plays a pivotal role in shaping your investment strategy. By providing insights into market trends and economic conditions, it allows you to make data-driven decisions that align with your financial goals. For example, if market commentary highlights a potential downturn in equities, you might consider reallocating a portion of your portfolio to more stable options like the G Fund or F Fund. On the other hand, if commentary suggests a bullish market, you might increase your exposure to growth-oriented funds like the S Fund or I Fund.

What Are the Risks of Ignoring TSP Market Commentary?

Ignoring TSP market commentary can lead to missed opportunities and increased risks. Without a clear understanding of market dynamics, you might make impulsive decisions based on short-term fluctuations rather than long-term trends. For instance, panic selling during a market downturn could lock in losses, while failing to capitalize on upward trends could result in missed gains. Market commentary helps mitigate these risks by providing a broader perspective and encouraging disciplined investing.

How Can TSP Market Commentary Help You Stay Disciplined?

One of the key benefits of TSP market commentary is its ability to instill discipline in your investment approach. By offering a steady stream of insights and analysis, it helps you avoid emotional reactions to market volatility. For example, during periods of economic uncertainty, market commentary can remind you of the importance of staying the course and maintaining a diversified portfolio. This disciplined approach is essential for achieving long-term financial success.

Read also:Exploring Odia Mms Video Trends Impact And Insights

Key Factors Influencing TSP Market Trends

Several factors influence TSP market trends, and understanding them is essential for making informed investment decisions. These factors include economic indicators, geopolitical events, and changes in monetary policy. Let’s explore each of these in detail.

Economic Indicators: The Backbone of TSP Market Trends

Economic indicators such as GDP growth, unemployment rates, and inflation play a significant role in shaping TSP market trends. For example, strong GDP growth often correlates with higher stock market performance, benefiting TSP funds like the C Fund and S Fund. Conversely, rising inflation can erode purchasing power and negatively impact fixed-income investments like the F Fund.

Geopolitical Events: Unpredictable but Impactful

Geopolitical events such as trade wars, elections, and international conflicts can create uncertainty in the markets. TSP market commentary often highlights these events and their potential impact on fund performance. For instance, escalating trade tensions might lead to increased volatility in the I Fund, which focuses on international markets.

Is TSP Market Commentary Reliable for Long-Term Investors?

While TSP market commentary provides valuable insights, it’s important to assess its reliability for long-term investors. Market commentary is based on current data and trends, which means it may not always accurately predict future outcomes. However, it can still serve as a useful tool for identifying patterns and making informed decisions.

What Are the Best Sources for TSP Market Commentary?

When it comes to TSP market commentary, not all sources are created equal. Some of the most reliable sources include financial news outlets, government publications, and investment research firms. Websites like Bloomberg, CNBC, and the Federal Retirement Thrift Investment Board are excellent places to start.

Expert Tips for Interpreting TSP Market Commentary

Interpreting TSP market commentary requires a critical eye and a solid understanding of financial concepts. Here are some expert tips to help you make the most of market analysis:

- Focus on long-term trends rather than short-term fluctuations.

- Compare multiple sources to get a well-rounded perspective.

- Align commentary insights with your personal financial goals.

How to Use TSP Market Commentary for Retirement Planning

TSP market commentary can be a powerful tool for retirement planning. By staying informed about market trends, you can make strategic decisions that enhance your financial security. For example, reallocating your portfolio based on commentary insights can help you achieve a better balance between risk and reward.

Frequently Asked Questions About TSP Market Commentary

How Often Should You Review TSP Market Commentary?

It’s a good idea to review TSP market commentary on a quarterly or semi-annual basis. This frequency allows you to stay updated without becoming overwhelmed by short-term noise.

Can TSP Market Commentary Predict Market Crashes?

While TSP market commentary can highlight potential risks, it cannot predict market crashes with certainty. Instead, it provides insights that help you prepare for various scenarios.

Is TSP Market Commentary Only for Experienced Investors?

No, TSP market commentary is valuable for investors of all experience levels. It provides accessible insights that can help anyone make informed decisions about their retirement savings.

In conclusion, TSP market commentary is an indispensable resource for anyone looking to maximize their retirement savings. By staying informed and leveraging expert insights, you can navigate the complexities of the financial markets with confidence. Whether you're a long-term investor or just starting out, understanding TSP market commentary can help you achieve your financial goals and secure a brighter future.

For further reading on retirement planning, check out this official TSP website.

Comprehensive Guide To Health Insurance Nebraska: What You Need To Know?

What Type Of Insurance Is Aflac? Everything You Need To Know

Explore The Flavorful World Of Bravo's Taco Shop Menu

Matabeleland Tuskers vs Mashonaland Eagles Match 3 Match Commentary

How It Works TSP Pilot